5 European Paper Industry Trends to Expect in 2026

Schades Group, 29 January 2026

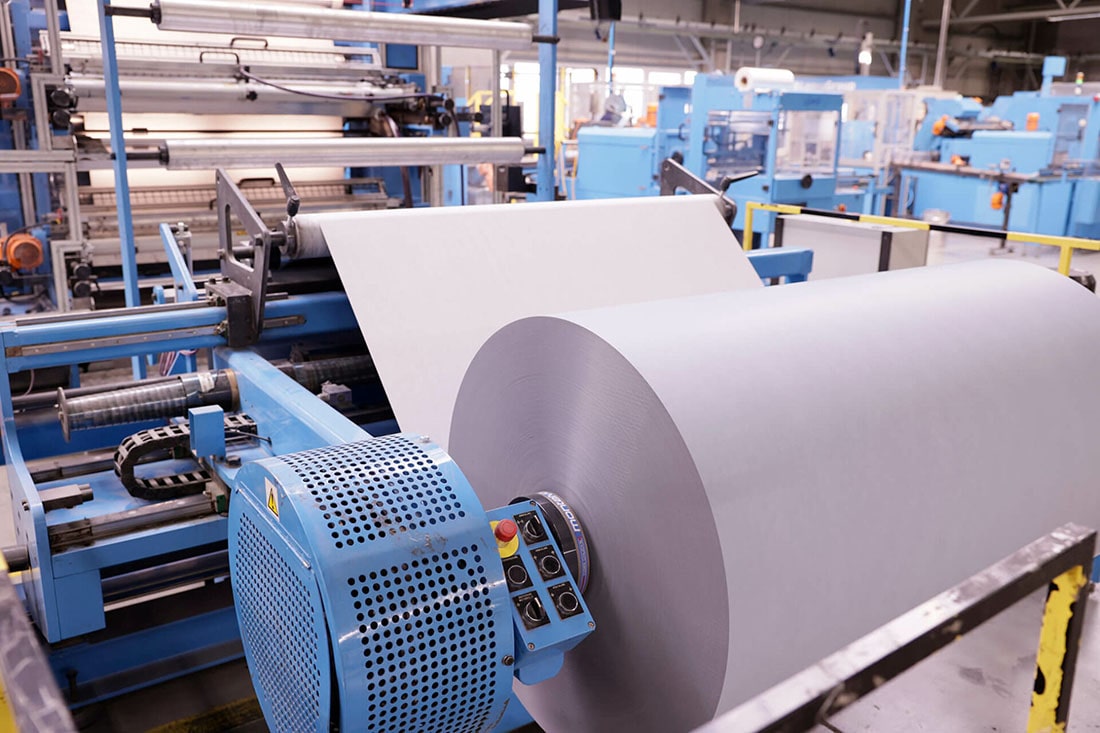

The European paper industry is a dynamic and resilient marketplace, set to reach 87.84 million tonnes by 2030. Shaped by global economic pressures, legislative change and geopolitical forces, the industry is constantly evolving and growing.

In 2026, we expect market growth to come from a strong demand for packaging, printing and speciality products. However, this growth will not come without obstacles – rising energy costs, the EU circular economy mandates and technological transformation all pose challenges.

At Schades Group, we expect a shift towards more specialised, sustainable and efficient production models this year, with the full enforcement of the EUDR and geopolitical pressures impacting market stability. In this blog, we explore the five major trends we anticipate will shape European paper manufacturers and buyers in 2026.

European paper industry regulatory changes

The first key trend that will shape strategic decision-making in the European paper industry in 2026 is sustainability and regulation. The EU’s circular economy objectives are already accelerating structural change across the paper and packaging value chain.

The anticipated full enforcement of the Regulation on Deforestation-free Products (EUDR) will influence the sourcing of materials, traceability requirements and compliance costs.

Paper converters like Schades Group will need to demonstrate deforestation-free supply chains, increasing the importance of certified fibre, robust documentation systems, and transparent supplier networks.

The EUDR has been a core focus for Schades group over the last year, as we further our commitment to sustainability. We have partnered with Osapiens to ensure full compliance with the EUDR, using their integrated tools to ensure transparent reporting.

Navigating EU regulations will remain a primary focus for Schades Group this year, to support long-term sustainability goals.

Sustainability as a growth driver in European paper manufacturing

With regulation evolving, sustainability can no longer be considered as just a compliance requirement, but as a competitive advantage that can define businesses.

Paper producers across Europe are increasing their efforts to reduce carbon emissions, become more energy efficient, and transition toward biomass and renewable energy sources. Investments in cleaner production processes, sustainable water management, and responsible forestry are critical in maintaining customer trust and securing long-term contracts – particularly as regulators and customers become more vigilant against greenwashing and unsubstantiated environmental claims.

The sector must also meet growing demand for sustainable packaging and high-performance industrial papers. Due to the EUDR and evolving consumer preferences, the industry is being forced to rethink its sourcing strategies, product design and manufacturing methods.

With sustainability becoming a key growth driver in paper manufacturing, paper converters such as Schades Group must also establish clear environmental targets to align with their value chain. This includes greater transparency around materials, processes, and suppliers, as well as demonstrating robust sustainability credentials and certifications. Schades Group is responding by investing in new technologies to support accurate measurement and reporting.

AI, IoT and cloud technology are redefining efficiency

New technology will continue to transform European paper manufacturing in 2026. With AI and IoT technologies being integrated into production environments, this enables paper manufacturers to optimise machine performance, predict maintenance needs, reduce waste, and improve energy management. These tools are becoming central to boosting productivity while controlling rising operating costs.

At the same time, advances in digital supply chain and logistics technologies – such as cloud-based warehouse management systems with real-time stock tracking, mobile scanning devices, and barcode integration – are enhancing transparency and responsiveness across the value chain.

By integrating cloud platforms into logistics and inventory processes, manufacturers can achieve real-time visibility of stock levels, improve traceability from production to delivery, and enable seamless data exchange with partners and customers, strengthening operational agility.

Beyond this, digital platforms and AI-driven analytics are increasingly being used to enhance supply chain visibility, demand forecasting, and customer behaviour analysis. This allows manufacturers to respond faster to market shifts, manage stock more effectively, and tailor product development to evolving end-user requirements.

As economic uncertainty continues and margins become tighter, digital and AI adoption will become integral to staying competitive and efficient.

Global trade shifts are causing market volatility

Market volatility is expected to persist in 2026, driven by ongoing geopolitical tensions, continued European paper mill closures, and new production capacity coming online in China. Together, these factors are reshaping global trade flows, increasing uncertainty around supply levels, and putting pressure on pricing across packaging, graphic, and industrial paper grades.

European manufacturers will continue to face structurally higher production costs, particularly around energy and labour, alongside fluctuating exchange rates that impact export competitiveness. At the same time, macroeconomic conditions – including inflation levels, central bank interest rate decisions, and currency movements such as a strong US dollar – will directly affect purchasing power, investment confidence, and cross-border demand.

In parallel, speculation around new tariffs, carbon border mechanisms, and import duties is already influencing buying behaviour, encouraging short-term stockpiling in some markets and delayed purchasing in others. These dynamics are likely to trigger sudden demand swings and increased price volatility. As a result, manufacturers will need to prioritise flexibility, data-driven planning, and closer collaboration with supply chain partners to manage risk and protect margins.

Eastern Europe’s expanding role in paper manufacturing

As other parts of the world navigate manufacturing capacity challenges, Eastern Europe is expected to see continued industrial expansion throughout 2026.

Investment in manufacturing infrastructure, logistics, and packaging capacity is supporting the region’s emergence as a key growth engine within the European paper market. This expansion is strengthening domestic consumption while also enhancing Eastern Europe’s role in export-oriented production.

As industrial output rises, this creates new sourcing opportunities but also intensifies regional competition. For buyers and suppliers alike, understanding regional shifts in capacity and consumption will be integral to maintaining stable, cost-effective supply chains.

Schades Group already has a presence in Eastern Europe under Omeko in Poland, but our footprint is growing with the recent announcement of our expansion to Istanbul, Turkey. This strategic expansion marks a new chapter as we bring our European quality standards, sustainability focus and customer-centric approach to Turkey. Our on-the-ground presence in Turkey will ensure customers receive support in their own language, faster response times, and a more hands-on service experience.

Navigating the European paper industry with Schades Group in 2026

In 2026, the European paper industry will continue to be shaped by sustainability mandates, technological acceleration, regulatory complexity, and geopolitical uncertainty.

While strong product demand remains, manufacturers will need to make strategic decisions about their supply chain, explore mergers and acquisitions, and generate investment to ensure they continue to grow and evolve with the market.

Businesses that proactively adapt to regulatory change, invest in digital efficiency, and embed sustainability at the core of their operations will be best positioned to succeed in the next phase of the European paper market.

To find out more about how Schades Group can supply the solutions you need in 2026, get in touch.